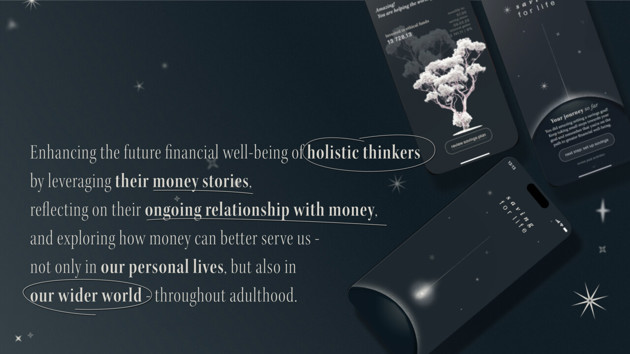

Project design statement: Enhancing the future financial well-being and exploring how money can better serve us throughout adulthood.

Carefree in 2060

A digital product concept focusing on an individual’s understanding of their unique and holistic value of money. Guiding the individual through cycles of present and future to obtain a healthy relationship with money towards financial well-being by leveraging theories on profound habit building. When we know that the use of our money aligns with our values and ethics and we know how to do that, we find resilience in any situation. When things around us change, we know how to follow our inner compass and use our money to lead a life that respects our true north so that we land with comfort and reassurance in retirement. We find a tangible way to affect our collective future. It is a reflection with oneself. A conversation to understand ourselves and the way we value and prioritise things in our lives through the use of money. So what does that look like?

Project information

The current Swedish pension system is relatively simple, with taxed incomes generating monthly pension incomes after retirement. However, the topic is accompanied by emotions such as guilt, shame, and anxiety regarding the right course of action. Future challenges such as increasing inflation, an aging population, and climate change threaten pension sustainability. On a positive note, the gender gap in pension incomes is projected to decrease from 30% to 4% by 2040, reflecting changing perspectives on women in the workforce and policymaking. These trends highlight how the pension system was built upon outdated values, underscoring the need to address inequalities and insecurities through sustainable approaches.

Method

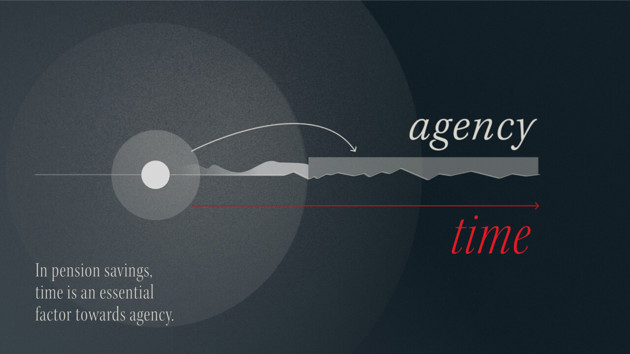

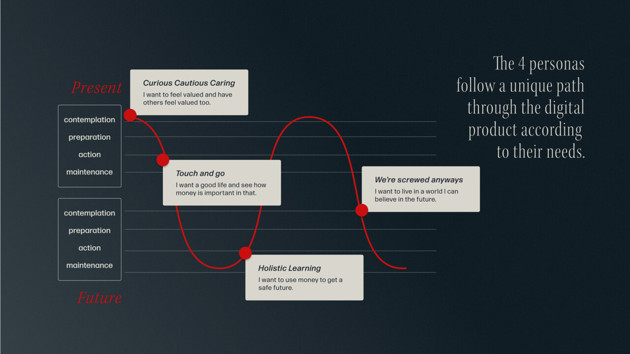

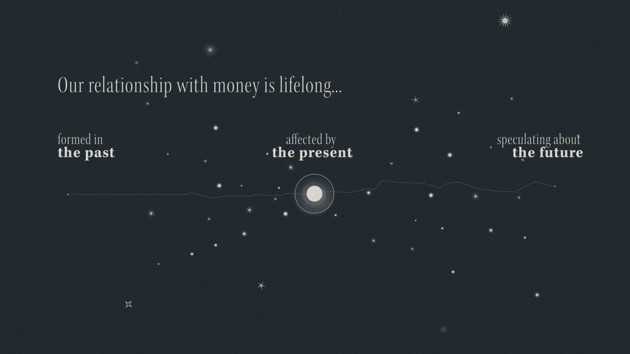

To learn about pensions on the personal, professional and societal layers, I was in conversation with professionals working for the pension agency, banks, savings solutions and researchers at economics and sociology departments at universities, as well as with individuals with diverse backgrounds with pension planning on their minds (or not). A pattern emerged where pension as a topic consistently related to the big moments in life and major financial decisions. These discussions revealed a disconnect between the simplicity of the pension system and people's perceptions of it. Approaching the scope of the pension system with methods from Actor Network Theory, looking at non-human elements as active participants, and speculative design, facilitate reaching new insights. The found possibilities permit to look at the present to increase an individual’s agency over time as it can be their biggest resource when income levels are low. In this project, I propose to look at money as an actor we have a relationship with, to scale away guilt, shame or anxiety and harness money’s positives. Through the strategic use of reflection, we can understand our ongoing relationship with money, shaped by childhood experiences, everyday life and planning for the future. By aligning our financial behaviours with our values, hopes, and dreams, we can transform our relationship with money and shape a future where it serves our aspirations. This is an unfolding process that starts today as our changed financial habits affect future consequences.

Results

Taking a holistic approach to financial planning exposes the inherent bias in the established system, which prioritises wealth growth and material possessions, thereby in one fell sweep rejecting those that do not speak the same language. Instead, what if we view money as a means of adding and prioritising values in our lives? This perspective led to the development of a simple app, focusing on emotional values and ethics rather than getting lost in complex technology. The aim is to provide tools that adapt to future contexts, enabling us to align our financial resources with the future we envision. Changes in behaviour are more permanent, more effective if the motivation comes from our values within, rather than being nudged towards another behaviour. This conversation with oneself, rooted in ongoing reflection on personal values, places significant emphasis on individual actions, moving from passive consumption to active reflection. Our present actions have an impact on others, both geographically distant and temporally removed – our future selves and future generations.

UID23 | Kimberley Beauprez – Grad Project Presentation

Individual agency is a powerful factor towards financial well-being. Understanding how to leverage it can enable new ways of thinking about money.

The main research insights show how there is more to pension saving than setting aside a sum of money each month until you retire.

Using the framework of Thinking Styles to define personas help to reframe it towards ways of thinking to understand the financial journey they face.

The speculative nature of money lies in the unfolding of the present, where understanding our past and our present can frame a new future.

Using the theory of the money story to help people understand their own emotional obstacles towards a better financial well-being.

It is crucial to know what your financial situation today is to get started. The graphic style steps away from prevalent numerical approaches in fintech.

Saving for the future is a form of speculation; by highlighting values rather than monetary wealth, the message addresses holistic thinkers rather than pragmatic thinkers.